What Is Ynab Classic

We offer all college students YNAB free for 12-months (in addition to the free 34-day trial). If you’re interested, write into email protected with proof of enrollment—think student ID card, transcript or tuition statement (but anything that shows you are currently enrolled and includes your name, your school, and the. I have YNAB 4 (the old classic version where you paid a one-off fee for life), but have recently started a trial of the new subscription service. I loved the old YNAB but within days of trying the new one - I'm sold and will never look back. You can trial it free for 34 days.

YNAB stands apart because it offers a unique layered combination of three key budgeting principles.

YNAB (pronounced Y-nab) is a popular budgeting software application. It has a loyal following, myself included. And for good reason.

What makes YNAB (it’s an acronym for You Need A Budget) so unique and why it stands so distinctly apart from other budgeting apps and spreadsheets is its combination of three vital budgeting concepts.

I don’t mean features. Features come and go. The YNAB development team has added and removed lots of features over the years in the software’s progression from a Windows-only fancy spreadsheet to the current subscriber-model web-based SaaS application.

No, I’m talking about the concepts. The principles. The methodology. The meta.

YNAB’s 3 Core Concepts

Layer 1: Envelope Budgeting

The Concept

Quite literally, the Envelope Budgeting concept is about physically separating cash into envelopes in order to physically separate one pile of money from another and then labeling each envelope with a specific, stated purpose.

For example, you might have an envelope for Rent and another envelope for Groceries.

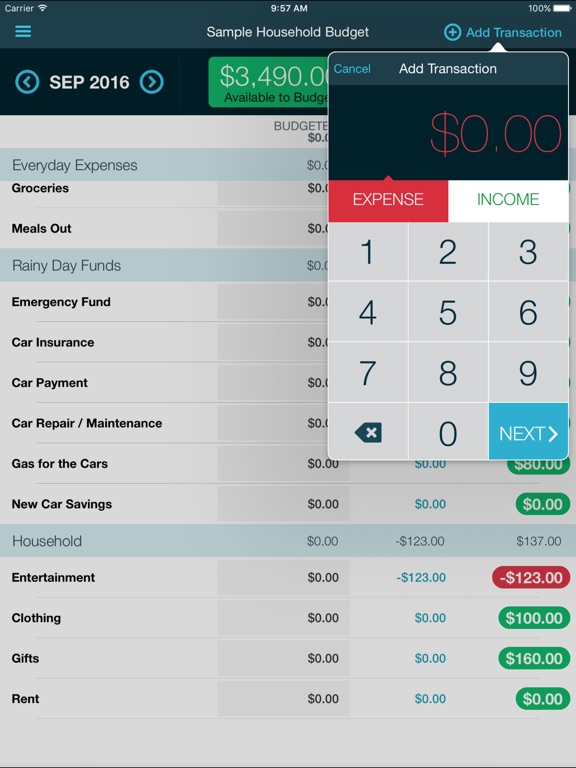

With YNAB and other envelope-based budgeting apps, the envelopes and cash are no longer literal. It’s representative envelope budgeting, not literal envelope budgeting. In YNAB, categories represent envelopes and the user electronically allocates representative dollars into those categories. Representative envelope budgeting is just as effective and has some major advantages over actual cash — especially during a pandemic.

Why It’s Important

Ynab App

Envelope budgeting has been used across many different cultures for hundreds of years. It’s a tried and true method of planning to meet expenses.

In super-simple terms, all budget envelopes serve one of two purposes:

- to ensure a specific amount is saved up and a goal met by a specific date or over a specified period of time, e.g. rent

- to aid in metering the flow of money out of an envelope to ensure funds don’t run out before a certain date or period of time, e.g. groceries

The value of envelope budgeting is that by isolating rent dollars from grocery dollars, rent money doesn’t accidentally get spent on food. If every trip to the grocery store begins by checking how much cash is left in the grocery envelope, you know exactly how much you can spend before even the first item is selected.

The weakness of this system is that it’s incomplete. Envelope budgeting calls for putting some of your money into envelopes but it doesn’t require you to put all of your money into envelopes. If you put some money in Rent and some money in Groceries and leave some money unassigned, you’re leaving yourself a big gaping accountability hole. If you have money that hasn’t been assigned to an envelope, there’s less incentive to avoid grocery overruns because you know you can simply use some of the leftover money to cover them.

What’s missing is the mechanism that strongly incentivizes you to avoid overruns. This happens only when the consequences of overspending are unavoidable and unambiguous. That’s where the next layer comes in.

Layer 2: Zero Based Budgeting

The Concept

Zero-based budgeting (ZBB) takes Envelope Budgeting one step further. Where Envelope Budgeting says you put some money into specific envelopes, ZBB says you put every single dollar into an envelope. Every single penny gets allocated to a specific purpose.

The result of every penny and every dollar having a specific job is that every dollar has only one job. Nothing is nebulous. Nothing is ambiguous. Gas money is gas money. It’s not coffee money or a loan payment or your next vacation.

So while in envelope budgeting you might have had a Rent and a Groceries envelope, with ZBB you’re probably going to have many more envelopes. The goal is to anticipate, and plan for, short- and long-term expenses; mandatory and discretionary expenses; fixed and variable expenses.

Zero-based budgeting is about intention. By assigning dollars into envelopes, you’re creating intention. By assigning every dollar into an envelope, you’re creating intention for every dollar.

The advantages of budgeting your representative dollars into representative envelopes are even clearer when doing zero-based budgeting. It would be highly impractical to keep all of your liquid assets separated into physical envelopes. Some people do prefer to keep their grocery money or their weekly beer allowance as cash in physical envelopes but hoarding cash for your next dentist appointment or your annual Costco membership dues seems a little impractical.

Why It’s Important

Zero-based budgeting solves the problems that envelope budgeting leaves unaddressed. What about everything else? How do I know that the unassigned funds will stretch far enough? And how do I incentivize myself to avoid cost overruns?

Overspending on groceries is one thing if you keep a coffee tin of unassigned money tucked away in your fridge. But with ZBB, every single overrun in one category forces a conscious decision — which envelope has to give up some money to cover the difference? Which one of my other plans do I have to change because this thing didn’t happen quite as planned?

It’s easier to buy that 6-pack and frozen pizza if the cost overruns are covered by a nebulous slush fund with no specific purpose. But if you have to decide whether pizza & beer are more important than rent or your car insurance payment or your anniversary weekend getaway, the consequences of your actions are much more clear.

ZBB is not about over-complicating or drowning in details. You might want to have separate envelopes for each different type of car expense right down to the stinky pine air fresheners but that’s certainly not necessary. ZBB is also not about over-planning or eliminating spontaneity. Love doing things on a whim? Me too. So I have an envelope that I keep well-funded for Whim Attacks. Let’s call it responsible spontaneity. Believe me, pre-funded fun is way more fun than unfunded fun.

Layer 3: Kitchen Table or Cash-on-Hand Budgeting

The Concept

I’ve investigated a lot of different budgeting methods, read a lot of articles and books, and explored a lot of different fintech options. Every single one that includes a planning feature takes the same approach: write down your monthly salary or anticipated income and then make a plan. YNAB alone takes an entirely different approach.

Central to the YNAB approach is the idea that budgeting must be limited to cash on hand. In YNAB, the first step is to list your current liquid asset accounts — checking, savings, wallet, etc — and enter your current balances. Then you make a plan with the money you actually have.

I made up “Kitchen Table Budgeting” based on imagery I use to explain the concept. Imagine you’re sitting at your kitchen table. You’ve emptied all of your liquid asset accounts — checking and savings — and piled them onto your kitchen table. You’ve also emptied your wallet and the jar holding spare change and added the contents to the pile on your kitchen table. Other than any non-liquid assets — investment accounts, retirement funds, and home equity — your money is all piled on your kitchen table in paper dollars and coins.

Now, with all your money in front of you, you begin the process of assigning each dollar a specific job. And only one job. You start with the most immediate or pressing needs — housing, food, utilities, loan payments. If you fill those envelopes and still have money on the table, you move on to other envelopes like gifts, clothes, vacation, annual fees.

You keep assigning dollars and cents to specific jobs until every penny on your kitchen table is tucked into an envelope. Then you stop.

Ynab Classic

This is the key. You stop when your kitchen table is empty, not when your envelopes are full. Anticipated income doesn’t count. Next week’s paycheck? Doesn’t count. The tax return that should hit your bank any day? Doesn’t count. Your quarterly bonus? Doesn’t count. Until it’s in your possession, you cannot put it an envelope.

Why It’s Important

Conventional budgeting is centered around anticipated income. Whether it’s a classic spreadsheet, Quicken, Dave Ramsey’s Every Dollar software, or even an old-fashioned hand-written budget, the unquestioned central premise is you anticipate your income and make plans from there.

In case it’s not painfully obvious, there are a few reasons why making current spending decisions based on anticipated income is a really bad idea. Unprecedented levels of unemployment ring any bells? Even if you have enviable job security, basing today’s plans on tomorrow’s income is putting the cart before the horse. It’s not a good way to make a solid plan.

Employment and salary security aside, anticipated-income budgeting leaves a whole host of folks out in the cold. Take Fang and me, for example. For most of my storied budgeting career, we haven’t been paycheck earners. Our income is variable and unpredictable both in terms of how much we earn and when we’ll receive it. As a coach I’ve worked with students who get large student loan disbursements that must be stretched out over entire semesters; educators who receive paychecks only ten months a year; seniors living on a patchwork of social security, pensions, retirement drawdowns, and/or reverse mortgages; service workers with no guarantee of hours and a base-rate of $2.15/hr; salespeople working on commission and people whose income is highly dependent on regular bonuses.

The shift from planning ahead with hypothetical, anticipated income to kitchen table cash-on-hand budgeting is profound. On the one hand, with traditional budgeting practices, you’re filling envelopes with IOUs and assuming you’ll be made whole before the bills come due. On the other hand, with YNAB, you’re anticipating all of your upcoming money needs but funding each one only when the money is actually available.

The reality of your financial needs and income is the same either way. But the perspective shift is dramatic. I see it nearly every time I work with a new client.

Let’s break it down with a simple example.

You sit down with a non-YNAB budgeting app. You list your regular monthly expenses: rent, groceries, gas, utilities, and a loan payment. Then the app asks about income and you plug in your monthly net salary. Everything’s good, right? Even if it’s tighter than you’d prefer, your salary will cover the expenses you listed. In a vacuum, perhaps. But this entire equation leaves out a critical element: time. How do the bill due dates and your living requirements compare to your next influx of money? [This is one of the reasons so many people are riding a credit card float.]

Now you sit down with YNAB. The first thing YNAB wants to know is how much you have in the bank. [Again, YNAB doesn’t care how much you make, the program wants to know how much you have.] You figurately empty your pockets onto the kitchen table. Now you address your upcoming needs starting with what needs to be covered first. The cupboards are bare, rent is due in a week, you’ll need to fill up your car soon, and, oh yeah, your annual Amazon Prime membership and your car registration are both due soon. And you don’t get paid again for another ten days.

Same situation; different perspective. Only one gives you an accurate, reality-based view of your financial situation.

Conclusion

You Need A Budget‘s software might not be perfect but their approach to budgeting can’t be matched. YNAB is the only product on offer that layers classic envelope budgeting with the more practically-sound zero-based budgeting principles and then tops off that winning combination with the truly unique cash-on-hand approach to allocating funds.

As a long-time YNAB user myself and an experienced money coach, I consider YNAB to be an essential tool no matter where you are on your journey to a better, happier, healthier life — however you define them and whatever your end goals.

Related Posts: